2024 Tax Credits for New HVAC in Glendale, AZ

2024 HVAC Tax Credits for New HVAC System – A Guide for Arizona Homeowners

Have you ever thought about how important your HVAC system is during Arizona’s scorching heat? It’s not just a nice-to-have; it’s a necessity for survival! With summer temperatures reaching extreme levels, keeping your home cool is crucial.

Choosing to upgrade your HVAC system can sometimes feel like a tough decision between enjoying a comfortable environment and dealing with high energy bills. But guess what? The Inflation Reduction Act of 2022 (IRA) has come to the rescue! This recent federal law provides valuable tax credits for HVAC upgrades, making it easier and more affordable to achieve energy efficiency. So, you can now keep cool without worrying about burning a hole in your wallet.

This guide to discover the HVAC tax credit savings opportunities available in 2024 With A New HVAC System.

Overview of 2024 Tax Credits for HVAC in Arizona

With the IRA, homeowners such as yourself are eligible for tax credits when upgrading to energy-efficient HVAC systems. These benefits will be available until December 31, 2032.

What Does It Mean For You?

HVAC Tax Credits

If you put in a qualifying HVAC system, you can get a tax credit. This means you’ll owe less in taxes when it’s time to file, all because of your environmentally friendly decisions.

Long-term Benefits

You’ve got plenty of time to get your hands dirty and make these improvements. Whether you’re currently renovating your HVAC system or have plans to do so in the coming years, you have a generous window to take advantage of these cost-saving opportunities.

These tax credits are designed to assist you in upgrading to an energy-efficient HVAC system, saving you money, and giving a thumbs-up to the environment. With the extension, they’re like a present that keeps on giving for the upcoming years.

Eligible HVAC Upgrades

Looking for HVAC upgrades that qualify for tax credits? Look for solutions that not only improve your home’s comfort but also save energy. Check out this list of eligible HVAC equipment:

- High-efficiency electric heat pumps

- Central air conditioners

- Duct and attic air sealing

- Added attic insulation

Selecting the correct solutions for your home is crucial in unlocking tax credits. By doing so, you’re not just enhancing your home’s energy efficiency, but also benefiting from financial incentives in the form of tax credits.

Details on Specific Rebates and Credits With New HVAC

The Inflation Reduction Act (IRA) of 2022 has a fantastic benefit for homeowners. If you’re planning to upgrade your HVAC system, you’ll be thrilled to know that you can enjoy a 30% tax credit. That means a 30% reduction in your tax bill! So, not only will your home become cozier and more energy efficient, but you’ll also save some bucks. It’s a win-win situation that you shouldn’t miss out on!

Check out these federal tax credits up for grabs when you make these upgrades:

- Heat Pump: $2,000

- Air Conditioners: $600

- Insulation and Air Sealing: $1,200

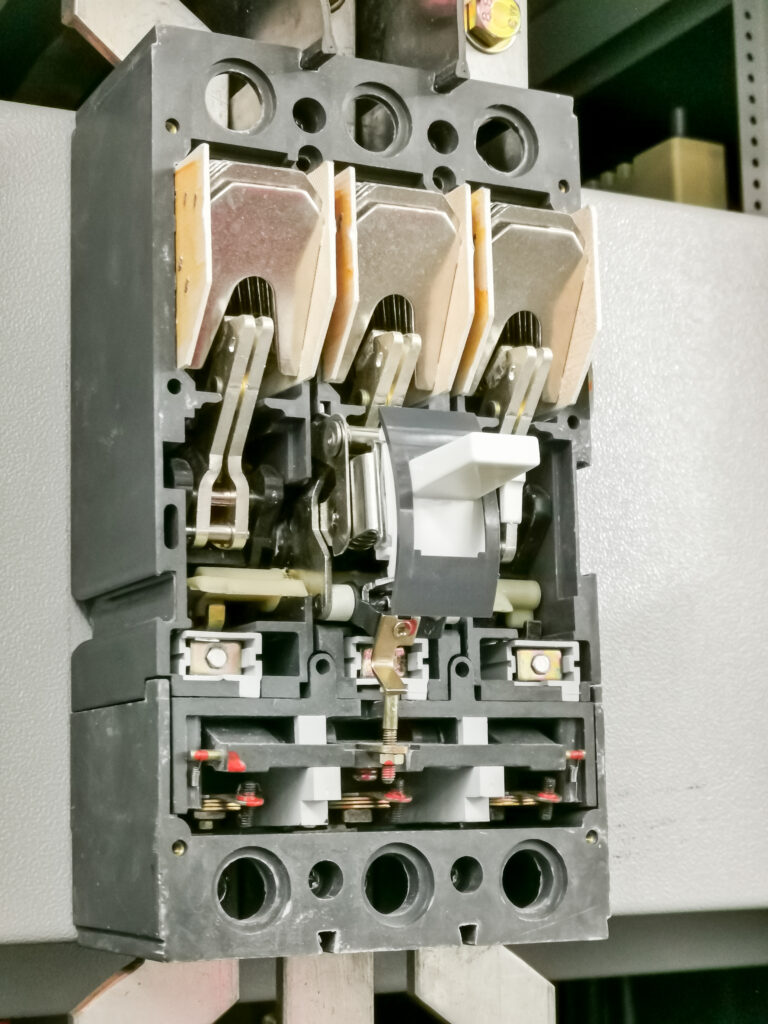

- Electrical Panel and Wiring: $600

You can receive up to $3,200 per year through this tax credit. It’s like getting actual cash back for making a positive impact on the environment and improving the comfort of your home.

Combine this awesome 30% tax credit with other rebates that are up for grabs, and you’ll be saving big time!

New HVAC Qualifications and Eligibility

Knowing the guidelines for snagging those HVAC tax credits is super important to ensure you’re ready to maximize your savings. Here’s the inside scoop

Residence Requirement

Don’t forget, that only the place you currently live in is eligible for these tax breaks. If you’re sprucing up your primary or vacation home in Arizona, then you’re in luck. But if it’s a rental property or a brand-new house, you won’t be able to take advantage of this deal.

Purchased and Installed Qualifications

To take advantage of these tax credits, all you have to do is become the proud owner of an energy-efficient HVAC system. Whether you opt for a stylish new heat pump or some additional insulation, as long as you buy and install it in your home, you’re heading in the right direction.

It’s important to ensure that it’s not just gathering dust in your garage, but actually bringing its magic to life in your home.

Limitations and Caps

The Inflation Reduction Act of 2022 puts a cap on the tax credits you can get. Let’s say you’re eligible for a 30% tax credit based on the equipment and installation costs. However, there are certain maximum amounts set for different types of equipment. So, while you can enjoy some savings, there’s a limit to the financial party.

In a nutshell, make sure it’s your own residence that’s getting the upgrade, have ownership of the equipment you’re installing, keep an eye on any restrictions, and presto – you’re all set to enjoy the advantages of the tax credit!

How to Claim Your New HVAC Tax Credits

Tax credits for your HVAC upgrades can be a bit overwhelming to figure out. This guide is your ticket to a hassle-free and successful process.

1. Gather Your Documentation

2. Know the Deadlines

3. Fill Out the Necessary Forms

4. Consult With a Pro

5. Submit and Track Your Credit

The Impact on Energy Efficiency and Savings

Arizona is setting the trend for energy-efficient homes, with 42% of new homes in 2022 earning an “Energy Star” badge. This not only saves money in the long run but also benefits the environment.

Long-Term Savings

Upgrading to high-quality heat pumps or other energy-efficient HVAC equipment means more than just maintaining a cozy home. It’s like investing in long-term financial benefits.

Your energy costs decrease, which eventually leads to significant savings. This results in a comfortable home and more money in your wallet.

Environmental Benefits

HVAC systems that are energy-efficient play a crucial role in combating climate change. By consuming less energy, they help reduce carbon emissions. Each degree cooler in your home translates to a degree warmer future for our planet.

Professional Installation and Compliance With New HVAC

Getting those sweet HVAC tax credits requires a top-notch installation that matches the quality of the equipment. That’s why professional installation is crucial.

Precision Matters

The professionals have the expertise to install an HVAC system correctly, ensuring optimal efficiency of your system. It’s not solely about enhancing comfort; it’s also about utilizing every bit of energy efficiently, maximizing your savings and making you eligible for potential tax credits.

New HVAC & Code Compliance

Local building codes are like the guidelines for the game. They ensure that your installation meets all the regulations, so you can qualify for those important tax credits.

Manufacturer’s Blessing

When it comes to installing HVAC systems, it’s crucial to meet the specific requirements to keep your warranty valid. Hiring professionals like Parker & Sons not only ensures that these guidelines are followed meticulously but also assures you that your equipment is installed exactly as the manufacturer intended.

New HVAC Tax Credits and Compliance

Upgrading your HVAC system in 2024 not only ensures your home’s comfort but also makes you eligible for tax credits. It’s a win-win situation for both your wallet and the environment.

Let The Professionals At Arizona Valley Heating & Cooling Help You Stay Compliant With Your New HVAC System and Get Rewarded With The HVAC Tax Credits.

Arizona Valley Heating & Cooling LLC offers AC Installation on Trane Brands. We also service most AC Brands as well! Feel free to contact us at 602-832-5786.